A Short Guide to the CTA

What is the Corporate Transparency Act?

Historically entity creation has been a matter of state law. Not all states require disclosure of owners and managers at the time of formation or in an ownership report. When law enforcement needs to determine who is behind a company and who is in charge it has had limited techniques in its toolbox. Most investigative techniques are 100 years old and require subpoenas to be issued on various parties. This time consuming process has made it difficult to keep up with bad guys who move quickly.

The Corporate Transparency Act (“CTA”) was added to the Bank Secrecy Act after decades of international pressure from the Financial Action Task Force. A bipartisan effort of Congress overcame a presidential veto to pass the CTA as part of the Anti-Money Laundering Act of 2020 in the National Defense Authorization Act for Fiscal Year 2021 – H.R.2513. It is now encoded in 21 U.S.C. §5336 and 31 C.F.R. §1010.380. The CTA purports to combat money laundering and terrorism, but it really targets everyday small businesses.

This new law revolutionizes the investigative power of law enforcement by creating a database of 30 + million small businesses. Company owners are incentivized to comply because of the teeth for non-compliance. The CTA aims to expose Beneficial Owners and make it easier to attribute corporate asset movement to real people.

Who is required to comply with the CTA?

Every company that is created by filing with a Secretary of State (or the equivalent in an Indian tribe or foreign jurisdiction and registered in the United States) is required to comply with the CTA. (21 U.S.C. 5336(a)(11)(A)). Some examples include LLCs, corporations, and limited partnerships. This includes over 32 Million companies. Less than one million of the reporting companies will be eligible for one of the exemptions that generally include large operating companies, 501(c)(3) nonprofits, and long-dormant inactive companies.

What are the penalties for failing to comply?

The penalty for willful non-compliance is $591 per day, up to $10,000, and up to 2 years in prison per violation. A CTA violation, when combined with other financial crimes, increases the penalties by up to $100,000 in fines and up to 10 years in jail per violation.

What companies are exempt?

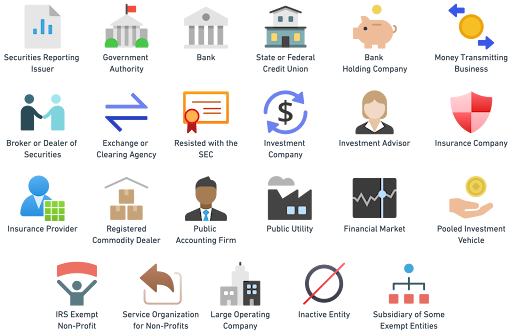

There are over 23 exemptions. The most common exemptions are for certain large operating companies, tax-exempt entities, and dormant companies, as defined in the regulations.

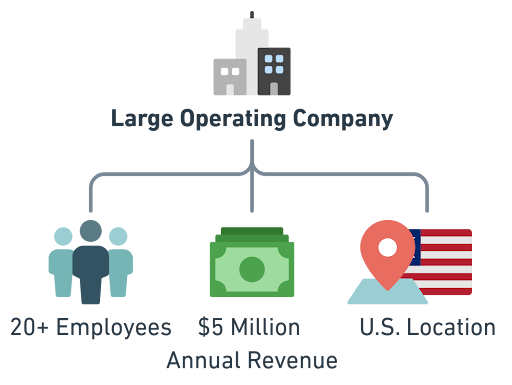

Large Company Exemption

The Large Company Exemption applies to Reporting Companies that (1) have more than twenty full-time employees, (2) have at least five million dollars ($5,000,000) in U.S. sourced revenue in the last tax year, and (3) have a physical office or location within the United States. All three elements must be met.

If the Reporting Company fails to meet all of these requirements at any point, it will be required to file a Beneficial Ownership Information Report.

Dormant Company Exemption

To qualify for this exemption, the company must meet all six of the following:

(1) filed before Jan. 1, 2020;

(2) is not engaged in active business;

(3) is not owned whatsoever by a foreign person;

(4) has not changed ownership in twelve (12) months;

(5) has no transactions greater than $1,000.00 in twelve months (12) months; and

(6) does not hold any assets whatsoever.

Who are the Beneficial Owners of a Reporting Company?

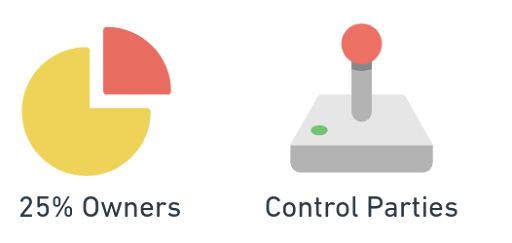

The BOI Report requires listing three categories of individuals defined as “Beneficial Owners.”

1) 25% Owners

First, this includes all natural persons who are owners with at least a 25% stake, directly or indirectly, in the Reporting Company. Indirect ownership often appears as multiple-layer entity structures. The BOI Report needs to map through all these layers to all individuals who have a right to receive 25% or more of the income or principal.

2) Substantial Control Parties

The second category of Beneficial Owners that need to be reported are all substantial control parties: the executive officers, such as the President, CEO, CFO, COO, General Counsel, Directors, Managers, or anyone with substantial control of a Reporting Company. Examples of substantial control include:

- Buy or sell most of a company’s assets

- Reorganize, merge, or dissolve the company

- Affect important contracts

- Set senior management salaries

- Amend company governing documents

- Decide major expenditures

- Set senior management salaries

- Amend company governing documents

- Decide major expenditures

3) Control Parties of the Reporting Company

The third category of Beneficial Owners that must be reported are all control parties of the Reporting Company’s Beneficial Owners. This applies when the Reporting Company is part of a multiple-layer ownership structure. FinCEN looks up the chain of ownership not only for individual Beneficial Owners but also for all individuals with control at each ownership level. FinCEN requires listing all individuals who can exercise control over any parent company or trust with 25% or more ownership interest in a Reporting Company.

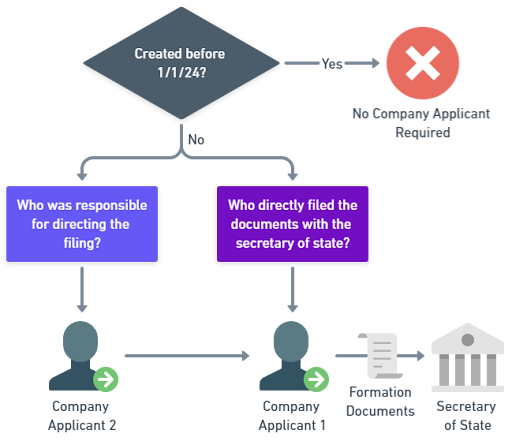

Who are the company applicants?

Only Reporting Companies formed after January 1, 2024, are required to include one or two “company applicants” in their BOIR. The first company applicant is the person who physically delivers the formation documents to the state. The second company applicant is the person responsible for directing that filing. Only if the Reporting Company was filed and organized by just one person without the assistance of a second person or filing service would there be just one company applicant. Otherwise, in all other instances two company applicants need to be reported to FinCEN in the initial BOI report.

What information should be included in a BOIR?

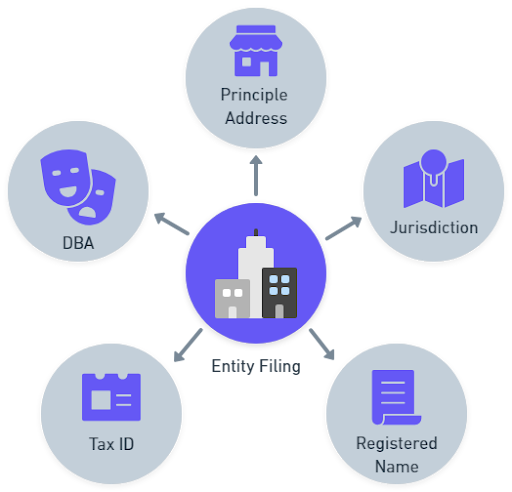

A) Reporting Company Information

For the Reporting Company, you will need to include the following:

- Full company name, plus

- All trade names and “doing business as” (DBA) names.

- U.S. Company physical address (Not a P.O. box)

- Tax-ID

- Jurisdiction of Formation

B) Beneficial Owner Information

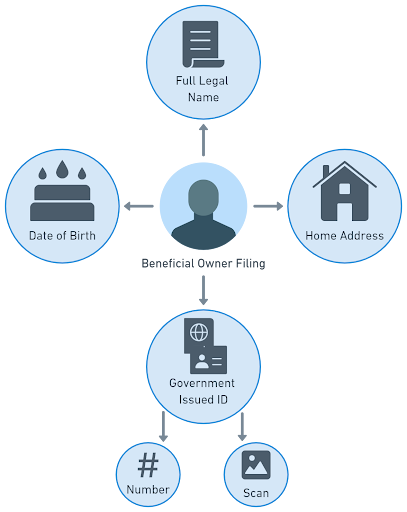

For each Beneficial Owner and control party:

- Full legal name

- Date of birth

- Home address

- Government-issued ID number

- Government-issued ID scan

A Government-issued ID can be a current state driver’s license or a passport that has not expired.

C) Company Applicants

Company applicants require the same information as Beneficial Owners. In many instances, the Company Applicant may have a FinCEN identification number that could be used instead of all other personally identifiable information.

When does a BOIR need to be filed?

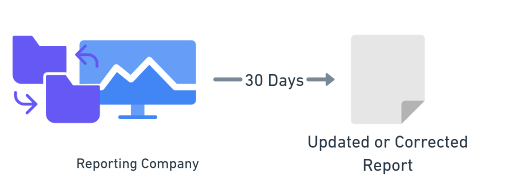

If the Reporting Company was formed before 2024, then the Reporting Company has until December 31, 2024, to file an initial BOIR. If the Reporting Company was formed in 2024, then the Reporting Company has up to ninety (90) calendar days from the date of formation to file an initial BOIR. Companies formed in 2025 and beyond will only have thirty (30) days from the date of formation to report. If a BOIR was filed with incorrect information, then the Reporting Company has only thirty (30) calendar days to file a corrected BOIR.

Reporting Companies need to monitor when reported information changes. An updated BOIR must be filed within thirty (30) calendar days of when information changes.

While the Reporting Company must updated reported information for Beneficial Owners, the Reporting Company does not update reported information for Company Applicants.

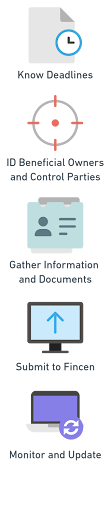

What should be done to comply with the CTA?

- Know the deadlines

- Identify Beneficial Owners

- Ownership interests

- Senior management or substantial control parties

- Control parties of parent companies and trust owners

- Gather documents and information

- ID documents

- Submit to FinCEN directly or through a third party filing service

- Monitor and update

- Updates must be filed within thirty (30) days for the life of the company

- Build a compliance program with consistent monitoring