Series LLC for Motion Picture Production

Why use a Delaware LLC for a Film?

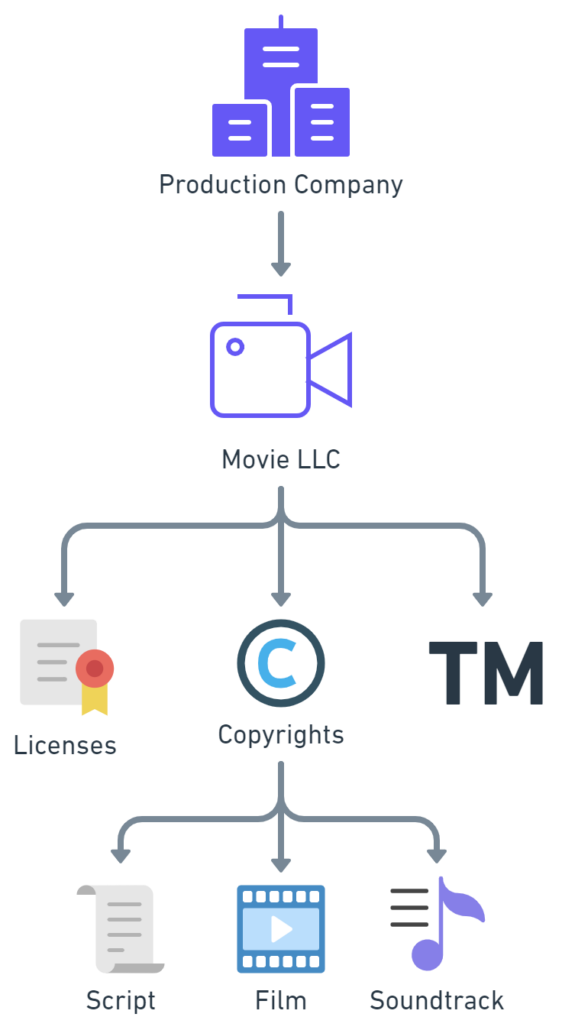

Producing a film requires specific types of intellectual property, and filmmakers create a separate LLC for each Production. A producer uses an LLC as a basket, holding an assortment of assets, including the intellectual property of the film, the contracts, the funding, loans, and distributing revenue to creditors, workers, and formed. Many investors will insist on forming an LLC in Delaware for a number of reasons, including, in part, favorable tax, business-friendly legislation, and case law from the world-renowned Delaware Court of Chancery.

The Delaware LLC Act and the Operating Agreement govern the Delaware LLC, enabling owners (called members) to set their own rules on how the LLC should be owned and managed. In contrast, a corporation often requires certain formalities that can be somewhat cumbersome and inflexible for an entity with the limited purpose of managing the production of a film.

What is a Series LLC?

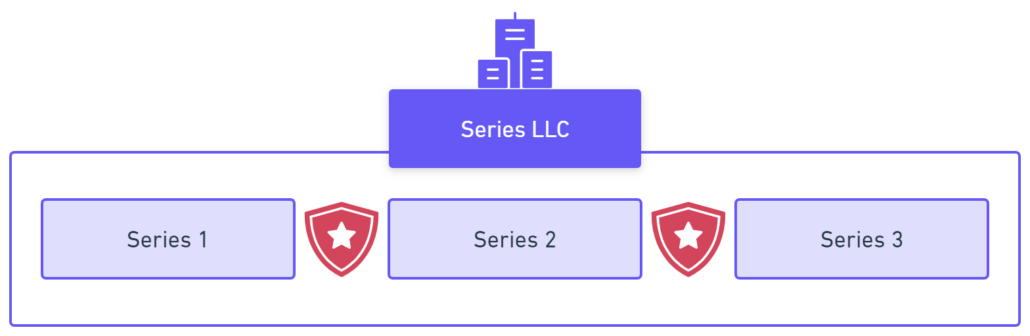

A Delaware Series LLC is similar to a collection of entities but only requires one company filing. A single filing empowers the LLC managers to create virtually unlimited “protected series” from time to time, which are akin to individual mini LLCs within one umbrella LLC. Each protected series provides asset protection by limiting the creditor of one protected series from attacking the assets of all the other protected series. Each protected series can have its own EIN and should have separate record-keeping of its assets.

Series LLCs are a form of cutting-edge asset protection for businesses seeking to insulate multiple assets from one another. The entity is designed to prevent judgment creditors of one protected series from reaching the assets of any of the other protected series. The way to create additional protected series is through the operating agreement, which avoids having to file and maintain separate entities for each grouping of assets if they were held in multiple separate LLCs. However, if a business wishes, it can file a series as a registered organization to create a “registered series” with the state of Delaware for a much lower fee than a traditional LLC. Sometimes, secured financing transactions require a registered series.

Why use a Delaware Series LLC for Film?

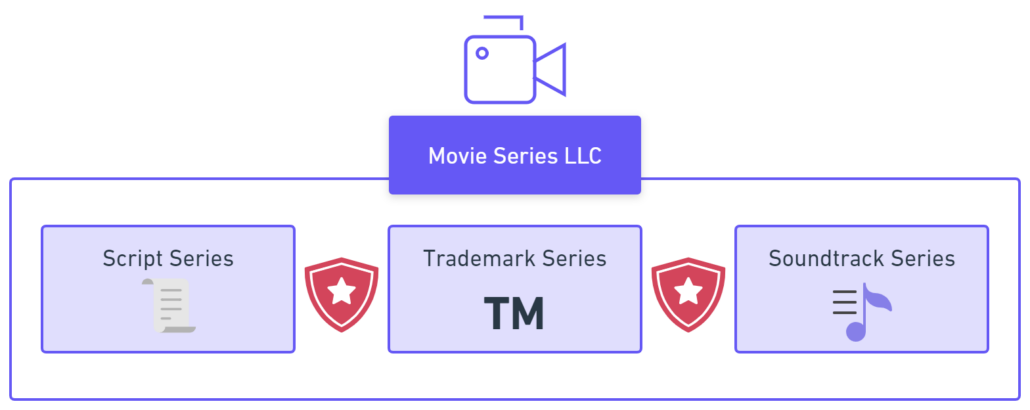

Delaware invented the Series LLC in 1996 through the Delaware LLC Act. Because a film often consists of multiple intellectual properties, the Delaware Series LLC can provide shields for each set of assets to avoid cross-collateralization. For example, a film production could have a Series LLC with a Script Series designed to hold the copyright for a script, a Trademark Series for the Trademark, and a Soundtrack Series to house music copyrights for the soundtrack. Each of these assets would then be protected individually without needing to file another LLC with the state. Each film could be in a separate series LLC. Combining multiple films into a single series would generally not be recommended.

The Delaware Series LLC is an efficient way to reduce the administrative costs and burdens associated with protecting multiple high-value assets from being reached by creditors. The flexibility of organizing a Series LLC also allows the filmmaker to find creative ways to organize financing and membership interests because each series can have different members. This can be an easy way to have a separate return on investment “waterfalls” for investors in assets or stages of production. Nothing is stopping an entrepreneurial filmmaker from using Series for multiple joint ventures. The real estate industry has used this asset protection tactic for over a decade, and it is becoming a powerful tool for filmmakers and entertainment professionals.